Many CPA’s & Accounting firms see ERISA audits and the preparation of 5500 documents as the primary source of fees from the qualified plan market. But these are just the tip of the iceberg.

Thousands of 401(k) and qualified plan sponsors are in dire need of professional services that CPA’s are uniquely qualified to provide. The majority of individuals who sponsor qualified plans are completely unaware of the compliance issues imposed on them by DOL & ERISA regulations.

A significant portion of sponsors are likewise unaware of the liability issues facing them as a result. The number of legal actions involving qualified plans has been growing steadily for some time now.

Additionally, the DOL has announced their intention to perform compliance audits of every 401(k) & qualified plan in the country (including yours) within the next five years. They have hired over 1,000 “investigators” for this purpose.

Most plan sponsors are completely unaware of this fact. A significant number of CPA firms are in-the-dark as well.

Annual Requirements

Every employer who maintains a qualified or group benefit plan should issue a request for services annually. This is the first of many compliance requirements.

The request should read like a standard RFP document and should include all of the following:

- Review of all service agreements with current plan advisers (a determination that agreements exist with each and every adviser).

- Determination of all plan fiduciaries.

- Verification that any plan adviser who is a named fiduciary has appropriate certifications.

A review should be performed confirming compliance with key code sections:

- 408(b)(2) Fee Disclosure Requirements

- Has a qualified Fee Disclosure Expert been engaged?

- Make a determination that FD Expert meets Independent Guidelines?

- Verifying that a Prudent Process was applied and appropriate documentation.

- Has a 404(c) election been adopted?

- Has the election been properly executed?

- What are the Fiduciary’s responsibilities under 404(c)?

- Has annual disclosure information been completed (Fee Benchmark)?

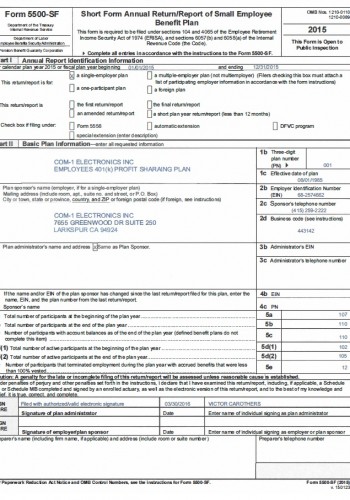

A prudent plan sponsor/fiduciary should have an overall analysis of the entire qualified plan compliance process performed every year. Finally, there is the annual preparation of a 5500 document & the qualified audit (where required) must be performed.

The fact is that the vast majority of plan sponsors are completely unaware of their compliance obligations. They don’t know which questions they should be asking and this is putting them at risk.

They need professional assistance and this is a compelling reason for you to make a contact and offer your services.

The marketing opportunities in the qualified plan market are virtually unlimited. And eventually they lead to the full gamut of services that CPA’s and accounting firms have to offer to operating businesses; financial statement preparation, tax preparation and planning.

Opportunity is awaiting those who take action.

As a practicing CPA, I recognized early in my career that my best clients were those who sponsored qualified plans. Profit sharing plans were the tried & true recommendation we gave to clients who came calling, asking for help in reducing their income tax burden?

That was more than 25 years ago; today that qualified plan itself has become the source of numerous consulting engagements.

Right now is the time for you to be contacting plan sponsors. July 31st is a filing deadline for over half of all qualified plans.

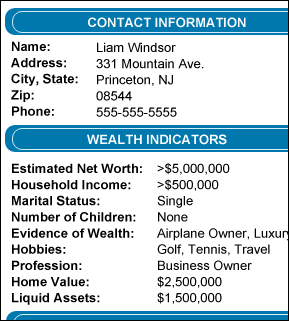

We manage a national database of every existing qualified plan in the country. The online database is updated daily. We have a history of data and plan filings for every qualified plan going back to 2003. We can tell you every plan that requires an ERISA audit and we can provide the audit report itself.

In addition to the data, we have:

- Red Flag listings, denoting non-compliance issues;

- A Risk-Profile disclosing a history of 70 different risk factors affecting a given plan;

- A Performance Report rating the performance of each and every plan against all other plans of a similar size and nature, nationwide.

We’ve designed a number of customized search queries to target plan prospects that are not in compliance with current regulations; are underperforming the market; require ERISA audit or have various other needs.

Sponsors’ needs for professional services are a compelling reason for you to make a contact and offer your services. The consulting opportunities available within the qualified plan market are virtually limitless. As a CPA you are uniquely qualified to provide these services; you are independent with no conflict of interest.

Our database of qualified plans should be part of the professional library of every CPA firm in the country. Not just for marketing but for research purposes too. Our database provides detailed information (officers, consultants, investment advisers, profitability, etc.) on close to 1 million successful businesses nationwide.

Call us today at 800-282-4567, ask for one of our business development specialists. We will be happy to help you with that initial contact. Or email us at cpas@larkspurdata.com and ask for qualified plan information.

Eugene A. Benson, Jr., CPA/CEO

Larkspur Data Resources, Inc.

PS The door is open to the accounting profession, limitless consulting opportunities exist within the qualified plan market.