It’s February, and if the new year has yet to bring you the new clients you hoped for, it’s not too late to make 2017, the year your business kicks into a higher gear.

We hear it all the time: “I buy lists and send out letters and emails, but the results are disappointing.” That’s because getting a list of potential customers is just the beginning of a successful business generation program.

We didn’t become the leaders in investor data by just supply contact information. We offer a proven training program that teaches you how to differentiate yourself from the hundreds of other advisers trying to reach the same high-net-worth investors.

Using a step-by-step process, taught by one of the most successful advisers in the business, we will walk you through the process and show you exactly how to accelerate your business in 2017.

We can take you there with a plan that will:

- Produce effective sales materials that will meet compliance guidelines.

- Separate you from the crowd, making you the standout in your market.

- Create a lead generation and follow-up system that will operate on auto-pilot.

- Provide the complete “Done for You” marketing toolkit.

Here are the three keys to effectively grow your production in 2017

- You must be able to identify your ideal client.

- You need to make it abundantly clear why you are uniquely qualified to solve your prospects problems.

- You must have a compliance-approved marketing system that will attract the right clients and take care of them so they become raving fans and a consistent referral base.

If you want to be the top producer in your domain, this is your roadmap to success. Go to Top Producers Coaching Club and get the details.

New Reports Fueling More Face-to-Face Meetings

And Generating Growth in AUM

In a recent John Hancock survey, investors ranked face-to-face meetings as their preferred method of interaction with financial advisors; followed by phone calls and then e-mail.

We’ve added a new report, FiduciaryOptimizer to Planisphere to help our advisors generate new face-to-face meetings and resurrect previous attempts to meet with sponsors of 401(k) and other qualified plans.

Larkspur Data has formed a strategic partnership with RiXtrema (Press Release), a leading provider of risk-management tools to the financial services community. RiXtrema’s tools are currently fueling significant AUM growth for advisors in the qualified plan market.

Through our alliance, Larkspur Data’s advisors can take advantage of the three primary elements that comprise the FiduciaryOptimizer tool kit:

- Provide plan sponsors with specific amounts of hidden management fees that can be saved by switching to lower-cost investment alternatives.

- Provide plan sponsors with diversification ratings that measure the otherwise obscured overlap that exists within their plan’s investment portfolio.

- Enable you to demonstrate how fee management & portfolio diversification will reduce sponsor exposure to liability and provide added compliance with DOL’s new Fiduciary Rules.

What sponsor would turn down a discussion of management fee savings with an increase in employee benefits, appropriate diversification and a reduction in exposure to personal liability? You can also point out the added compliance you’ll be providing with new ERISA regulations.

Each report includes all the figures you need to highlight the available savings. This is the sales tool you’ve been looking for.

Without a doubt, FiduciaryOptimizer will generate more face-to-face meetings and fuel asset growth. It is well recognized that fee inefficiency is pervasive in the 401(k) market. This report is an attention-grabbing sales tool; a door-opener that will enable advisors to speak directly with plan sponsors about cost savings, diversification and reduced exposure to fiduciary liability.

Call one of our marketing specialists and ask them to show you how you can use this tool to generate new face-to-face meetings with plan sponsors. 800-282-4567.

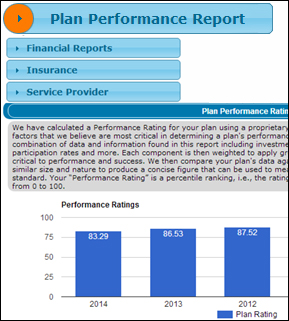

Revisions to Plan Performance Report

Added Graphics to Grab Your Prospects Attention

We’ve also revised our Plan Performance Report to include more attention-grabbing graphics and clearer data presentation.

The most recent report features:

- Clear and concise performance ratings

- Rates of return, investment fees and expenses

- Objective ratings that compare every plan nationwide to their Peer group

We also have DALBAR’s Success Factor rating highlighting income replacement or lack thereof, at the time of retirement.

Consider the impact of telling an employer that his company’s 401(k) plan is projected to replace only 25% of his employees’ pre-retirement income? This is definitely not good news, but it will certainly gain their attention.

You will not find this information anywhere else; it is proprietary to Larkspur Data.

The Planisphere product now includes a designated Search Tab for Prime Targets. This Tab will lead you directly to problem plans that require assistance with any of the following issues:

- Plans with Low Performance Ratings

- Fiduciary Issues

- Obvious Risk Factors such as Corrective Distributions

- Late Contributions

- Fidelity Bond Issues

- 404(c) Liability

- Lack of QDIA

- Continuing Poor Performance

- Negative DALBAR Success Ratings

You can save the search criteria from any one of your Prime Target queries to use again & again.

We’re ready to discuss the application of any of these tools to your marketing program for 2017. All of these tools/reports will set you ahead of the pack in 2017.

See below for more detailed information.

This report will open the door to new clientele. It’s designed to generate the urgency that will lead to face-to-face contacts with plan sponsors & decision makers.

Quickly locate plans that are Prime Targets for your services. Problem plans with obvious filing errors and fiduciary issues…

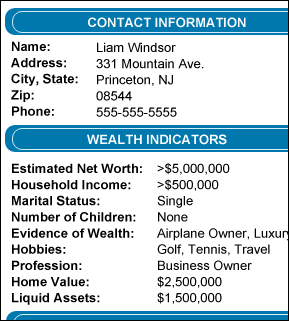

Prospects of Wealth is our searchable database of 4 million High-Net-Worth individuals. We have over 40 wealth indicators and other characteristics pointing to accumulated wealth.